Quarantine binging is a thing. The king of streaming, Netflix, reported a record increase in subscribers during the coronavirus crisis. We are no strangers to binge watching. However, our poison is the “Netflix of Finance”, Real Vision TV. The channel was founded in 2014 by the charismatic macro investor and ex GLG Global Macro Fund Manager Raoul Pal and his pals Damian Horner, Grant Williams and Remi Tetot.

Real Vision is an on-demand financial TV channel that conducts interviews with experts in the field of finance, business and the global economy. Among them are well know investors, hedge fund managers, and financial researchers.

This sounded naturally interesting for us. Hence, we subscribed to the service for as low as $1 (it was a promo thing).

Now, the time has come to balance accounts. And what better way for a bunch of Systematic Investors like us than analyzing content systematically!

For that purpose, we have teamed up with my former colleague, Dominik Schneller at the University of Augsburg. As a specialist in textual data and sentiment analysis, he was eager to support us in this urgent and highly academic matter of research.

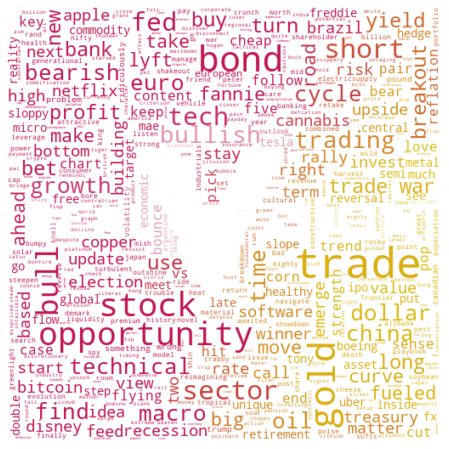

For our project, we downloaded all the historical transcripts of format called ‘Trade Ideas’ which was updated frequently between January 4th, 2018 to March 12th, 2020. We did some heavy data plumbing. On the way, we created an AI that generates Tweets from these interviews, the RealVisionBot. Sometimes it’s even funny, but most of the times it’s just bullish on Gold and Cryptocurrencies while questioning the authorities.

However, our main focus was extracting the sentiment of the trade ideas as well as systematically analyzing trade performance of the ideas. Since many of the ideas entail a very detailed specification of the trade we are able to analyze this ‘systematically simplified’ version of the trade. Note that we do believe that most likely a better implementation of the trade can be achieved if additional information of the trade idea is processed by an informed human trader. For our analysis, we deliberately keep the discretionary choices to a minimum to avoid hindsight bias.

The research note itself can be found on my Research Gate page. And since Moritz S. likes pictures, I put the same paper inside a colorful Jupyter notebook, where you can play around with the charts.

For your convenience, here is a quick summary:

The note gives unique insights into the performance of trade ideas extracted from 311 interviews of professional investors and money managers, which where streamed on the “Netflix of Finance'” – Real Vision between January 2018 and March 2020.

Our first results indicate, that the return distribution of trade ideas with a systematic set of trading rules such as entry, exit and stop-loss exhibits higher positive skew, less volatility and fewer outliers compared to trade ideas that are less specific. Especially for trades with a price target, the specification of an entry rule seems to be a decisive factor for trade performance. Our analysis shows that even for discretionary ideas, systematic rules play an important role. Besides making a trade idea testable, they reduce downside risk while allowing for upside potential.

Note that this is an ongoing project, so changes and extensions are coming. Especially our sentiment analysis will highlight additional interesting aspects of the interviews,

To answer our initial question: Was the subscription worth its money? Judge for yourself.

We definitely confirmed our deep and dark suspicion about investing: A good discretionary idea is best executed systematically.

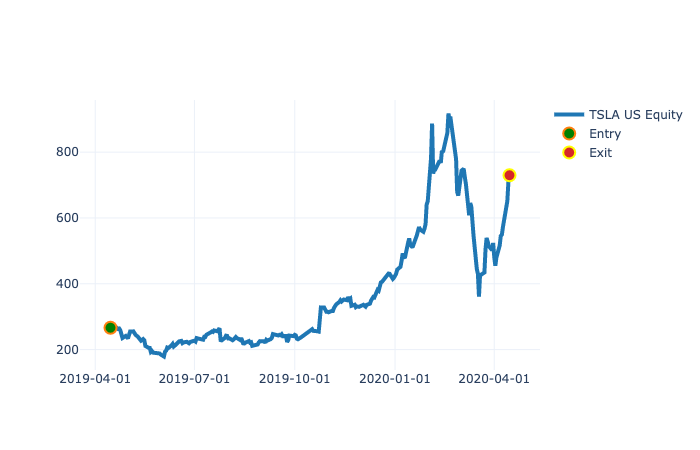

And for everyone who wants a chart. Here is one of the trades from the sample. A very confident $TSLA trade. Looks good? Well, it was a short. And it didn’t have a stop-loss …

For the complete research report follow the link to my Research Gate page. A notebook with interactive charts where you can view all the individual trades will follow soon!

#happytrading