Your weekly dose of liquid brainfood

Our weekly review of things that caught our attention. Some things new, some things aged. Just like a good wine. From easily digestible to the hard stuff.

- Reflections on 2019 made simple: Use the BlackRock Geopolitical Risk Index as a substitute for year-end reviews

- Why Trend-following hasn’t performed as expected in the last decade compared to a 140 year sample. Hint: it has to do with the average market moves being more muted. You Can’t Always Trend When You Want, by Babu, Hoffman, Levine, Ooi, Schroeder, and Stamelos (AQR)

- Old but gold, William Eckhardt: The man who launched 1,000 systems.

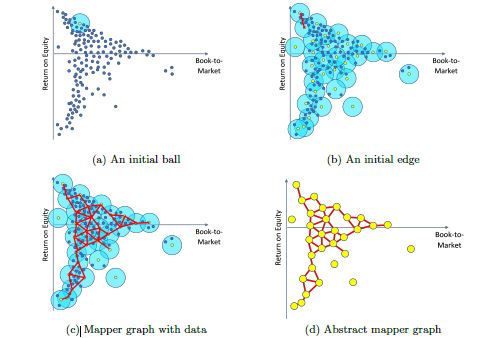

Academic paper of the week: Financial ratios and stock returns reappraised through a topological data analysis lens by Pawel Dlotko, Wanling Qiu, Simon Rudkin.

Sounds crazier than it really is. The authors demonstrate the usability of an algorithm to analyze complicated and noisy data, the so called TDA (topological data analysis) Ball Mapper. For their application, they use a set of anomalies from the asset pricing literature and visualize the multi dimensional data into a two dimensional abstract graph to spot patterns if relationships within the data. A fun and interesting way to interpret factors. In their visual interpretation high book-to-market stocks seem to yield below average return on equity, which should sound very familiar to the current crowd of value investors.