Input for your monthly performance review. A fully diversified portfolio of trade ideas.

For everyone who has been living under a rock for the last couple of days: The S&P 500 plunged by roughly 13% over the last seven trading sessions after the inconvient truth that COVID-19 will have economic impact has hit markets. There are a lot of interesting discussion going on, such as the inteview with Marc Lipsitch, an epidemiologist at Harvard University that between 40 to 70 percent of adults in the world will become infected with the coronavirus and the Virus won’t get away soon (similar to the common flu). However he doesn’t seem to mention an expected time frame for his forecast. Definitely noteworthy is this study on the Virus fatality ratio by Marc Bevand, which highlights that the naive fatality ratio (dividing deaths by observed cases of infection) of 2% is highly inaccurate.

The naïve CFR (case fatality ratio) was severely inaccurate due to “simply an artifact,” a lag: “the final outcome for patients [death or recovery] lagged behind their identification by approximately 3 weeks.”

Calculating a resolved CFR and making some parameter assumptions, he estimates the fatility ratio to be around 1.6%, which “would be 16x deadlier than the seasonal flu (0.1%). The flu kills half a million worldwide every year, so 2019-nCoV would kill a few millions.”

If you want to have a look at some parameter variations we suggest this Jupyter notebook developed by Antonio Catalano.

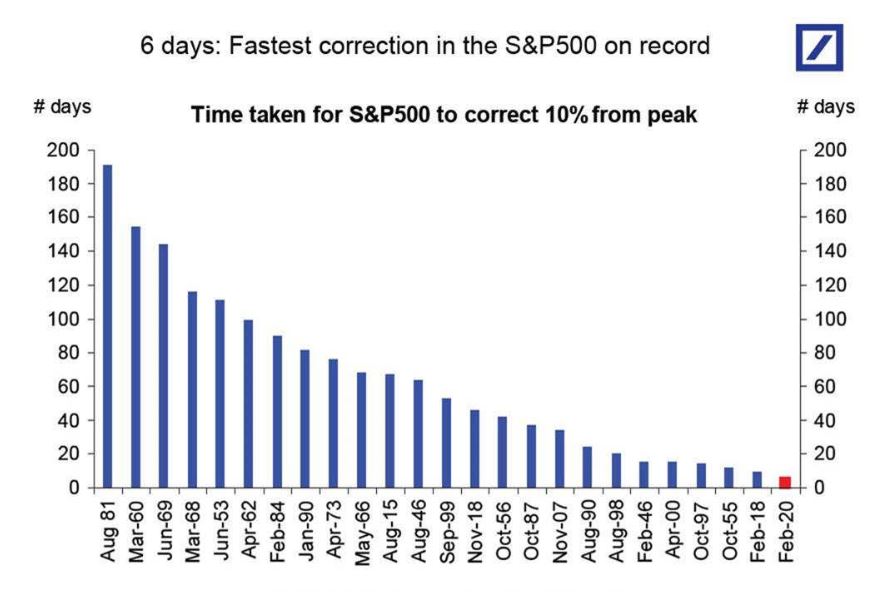

Not being epidemiologists, let’s turn to the markets again: According to Deutsche Bank’s analysis, last weeks decline of – 11.7% was the fastest such reversal on record for the S&P 500 in history.

But wait, there is more: Not only did equities get whacked, also Gold dropped by more than 3% due to profit taking. So are there any good news? Seems as if investors are expecting more touble to come: VIX curve went into backwardation. An interesting tweet related to the topic was also sent out by Chris Cole, who attributed the 7 points difference between short term VIX futures and VIX spot to selling pressure created by hedgers monetizing on their hedge, similar to the Gold case mentioned above.

As retail and proffesional investors have raced to monetize hedges by selling VXX at record levels, this has a created a unique distortion where you can buy front month VIX futures at a discount to SPX realized volatility, and 7-10 points below the VIX.

— Christopher Cole (@vol_christopher) February 27, 2020

If you reached Thursday last week without indulging in any kind of drinking to calm your nerves: Good for you! We didn’t! However, activating our green fairy superpowers gave us some ideas on how to profit from the supposedly upcoming storm. So have a sip and read on.

So, here are three easy ideas, which are clearly no advice and should not be implemented by anyone. Some of them are real classics, so that’s why I put them here.

- Take your money and run! Just kidding. If you believe in comebacks, now could be the perfect time to invest in value stocks. Why? Well, first of all they seem to be undervalued. Or as Cliff Asness puts it: It’s time for a venial value timing sin. But second of all, if you think the Virus situation will carry on but you still want Equity exposure, you should look for something that is less affected by inflation. You know, no production and supply chain interruptions in China means potentially higher prices for goods and commodities. So having a low duration Equity basket might be beneficial as soon as interest rates will rise to battle inflation. Also note that since this is not a crisis caused by the financial sector, rate cuts might not be the solution. Rather helicopter money and tax cuts seem to be the measure of choice to alleviate the pressure this situation puts on individuals and businesses. The trade can also be implemented via short puts on single names or value ETFs.

- The steepener trade. Probably the favorite trade of Kevin Muir from the MacroTourist. If you expect the FED to act nonetheless and support the economy by cutting rates in the short term but you are expecting higher inflation in the long term, this might be your choice. Also note that if institutional portfolios are hit by the shock in equities, they might be driven to long term bonds again (play it safe), making the trade attractive. If you are thinking interest rate volatility AND inflation, look no further than the IVOL ETF. A match made in heaven.

- Dividend futures. In times of stress, there is downward pressure on prices as dealers hedge out the risk across billions of dollars of retail structured products by offloading dividend futures, which often causes the dividend futures market to trade at a deep discount. Even option markets on some dividend futures exists and buying calls or putting on risk reversals may make sense.

- Trend following! While for mid- to long-term CTAs last week surely was no picnic either, the same held for the financial crisis in 2008. However, convexity and positive skew did pay-off once the crisis carried on. Also note that some short-term CTAs performance during the last few days was exceptionally good, I strongly advise you to have a look at the 40in20out Real Time Trend Trading Experiment.

Since the last part of the weekly review has somehow become kind of a homework section: Read this, study that, get a drink and trade your way into the week. We will finish with suggesting to read this article where Trandstrend’s Harold de Boer talks about the evolution of trend following. The topic was also discussed by Nils, Jerry and Moritz on last week’s episode of the Systematic Investor Podcast.

While we can’t agree more on this,

Unorthodoxy doesn’t sell well; it essentially states: we do not worship what most investors believe.

some parts are also irritating:

The focus has shifted from trading as many as possible markets to striving to be sizeably positioned in different trends. If a market is just a less efficient way of trading the same trend that can be more efficiently traded through other instruments, there is no value in trading it,” says De Boer.

We believe that the correlation between markets is never perfect and therefore increasing the number of markets yields diversification benefits and widens your spectrum to place bets.