After last week’s launch of the new TwoQuants website and our attempt to break the ice between N. N. Taleb and C. Asness, I want to take the opportunity to formally introduce ourselves. However, due to frequent requests I have to inform you that sadly the mug depicting the argument between Cliff and Nassim is no longer available. So lucky Cliff, who might have still been able to get one.

I bought one. https://t.co/Td2RBuibuI

— Clifford Asness (@CliffordAsness) May 29, 2020

By the way, the whole story went into another round, which was however much less entertaining. It’s probably more informative to read the Bloomberg article discussing technical details.

So back to the topic: The TwoQuants. As you might already have guessed from our about page or our twitter account, we are really two Quants working in the financial industry. Conveniently, we are both named Moritz. Even more conveniently, we are both working together. Since our daily business often consists of reading, research and wild thorough analysis of financial markets, positions and data, we wanted to take this chance to share our knowledge and personal views with a broader audience. Pre-corona we often discussed our findings while sharing a nice Old-Fashioned, Negroni or any other beverage that sparks the creative flame. As a result, the Two Quants often went to bars; and that’s how the name of this website was born. If you haven’t explored our content yet, it’s not much, but we promise there’s more to come. Currently you can sign up for our weekly newsletter, follow the blog, listen to the “talking Moritz” on the Systematic Investor Podcast and have a look at our favorite books. The most important part of the page, the implementation and live trading of our own TwoQuants Systematic Trading Models is due to follow within the next weeks. Until then, you can enjoy your own drinks while we share our insights and things that attracted our attention with you. So, take a seat at the table and let’s dive into this week’s topics!

After some serious money printing action and volatility being back to calmer waters mid May, the world does not actually seem to calm down: Trade tensions, social unrest and the impact of the Corona crisis on the economy (and especially lower and middle income countries). You name it. Add to that the warning that US pension plans will run out of money as soon as 2028 and you already wished you had bought that nice underground bunker.

However, there is also good news: Good news for gold (which you can’t just print). It’s summarized in this just 356 pages long report, which claims to be “the gold standard of gold analysis”. Alternatively you can also listen to the author of the report on the current episode of Macro Voices. Let me highlight the key takeaways from the short version of the paper (only 93 pages!):

- Monetary policy normalization has failed

- The coronavirus is the accelerant of the overdue recession

- Debt-bearing capacity is reaching its limits

- Central banks are in a quandary when it comes to combating inflation in the future

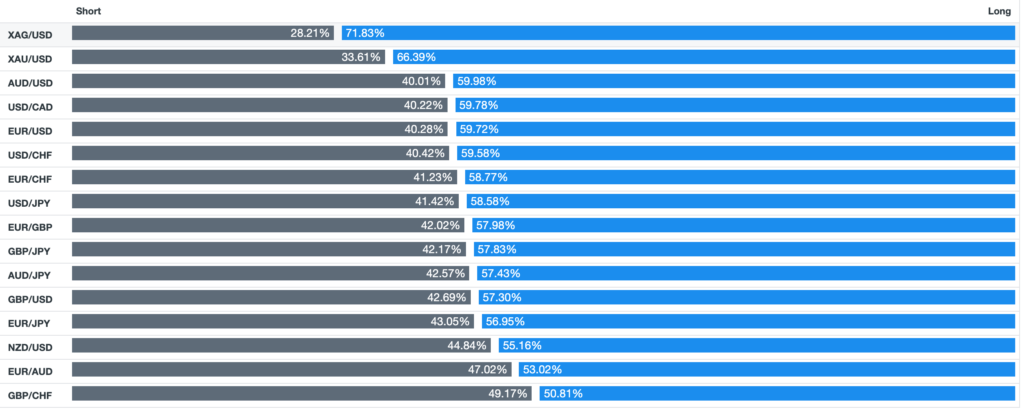

This leads the authors to declare the dawn of a new monetary world order and sepculate that new gold all-time highs are only a matter of time. To get a little bit of an insight what retail is currently thinking, you might want to have a look at the current open currency positions at oanda.com. So not only are the authors of ingoldwetrust very bullish (who would have guessed!), but they are very much aligned with the positions at one of the largest retail FX brokers, where people are on average predominantly long gold (66.39% of positions). Another interesting fact is that investors are even more bullish silver (71.83% long positions), which is most likely related to hopes for industrial recovery and thus increasing demand. Thus if you are thinking of following the herd, silver might be a better choice.

Talking about following the herd, what’s actually going on in the Trend Following world? On the weekend, Bloomberg published an article about Volt Capital, a Swedish Hedge Fund, which attributes its decent performance over the last month to their “rare” AI model. However, this statement from Patrik Safvenblad, the fund’s chief investment officer sounds a lot like they are sticking to basic Trend Following rules: Cut your losses and let your profits run.

The market is always right,” Safvenblad said. “We don’t think we know better than the market. So when something goes against us, we decrease exposure to those positions, models and sectors. We simply close positions that don’t work. This way we can increase to positions that do work.

The rest of the AI magic sounds a lot like something which you can achieve with Bayesian Asset Allocation. If you are interested in that stuff, here is a nice paper by Vadim Sokolov and Michael Polson that illustrates the methodology using the holdings of two different hedge funds, namely Viking Global Investors and Renaissance Technologies.

Two interesting research papers crossed my desk last week. The first one is Risk Management and the Role of Volatility by Kathryn Kaminski from AlphaSimplex. It’s a short but worthwhile piece of research that looks at the benefits of combining risk (in terms of volatility) managed strategy with a non risk managed strategy. If you want to have deeper insights from the academic side, you can have a look at “The Impact of Volatility Targeting” by Campbell R. Harvey and the Man AHL crew. The AHL paper questions the usefulness of volatility targeting for some asset classes, but the authors make quite a strong historical case for volatility targeting given that their dataset starts in 1926 for Equities, 1962 for bonds and 1988 for the commodities and currencies portfolios. Their main finding is that

Volatility scaling at both the asset and portfolio level improves Sharpe ratios and reduces the likelihood of tail events.

Note that the way of volatility targeting in the portfolio context is different from the way CTAs manage risk by position sizing. Not only do price based systems often use the more convenient ATR (see here for a post on the relationship between ATR and standard deviation), they also fix the position size when entering the trade, while vol scaling “constantly” adjusts the position size over the lifetime of the trade. In the context of the above research volatility scaling introduces artificial momentum into (long only) strategies:

Volatility often increases in periods of negative returns, causing positions to be reduced, which is in the same direction as what one would expect from a time-series momentum strategy.

If you are looking for more academic papers, make sure to check out “Tail Risk Mitigation with Managed Volatility Strategies” and the classic “Volatility-managed portfolios“. But beware: These papers neither deal with multi-asset long-short portfolios nor do they compare their results against position based risk control mechanism. We will dedicate a future post to that topic in particular.

The second paper was published by Winton and shared by Jerry Parker:

“Trend following can provide diversification from strategies that are reliant on market forecasts. The strategy can, counterintuitively, behave in a contrarian manner, by taking positions that conflict with market consensus, narratives, and fundamentals.”https://t.co/F1rf1rWZId

— Jerry Parker (@rjparkerjr09) May 30, 2020

The paper makes an interesting case for price based strategies in contrast to models that rely on fundamental data such as economic forecasts. The authors argue that especially in highly volatile times forecasts from analysts show a high dispersion due to increased uncertainty. In contrast:

Strategies that rely only on intrinsic market data – such as prices and trading volumes – avoid the uncertainty associated with fundamental data. This is because prices are reliable metrics as long as markets remain liquid and assets can be marked to market.

I highlighted the magic words in that quote. Out of curiosity I quickly checked the current volatility of survey results among private investors regarding their sentiment of the S&P 500.

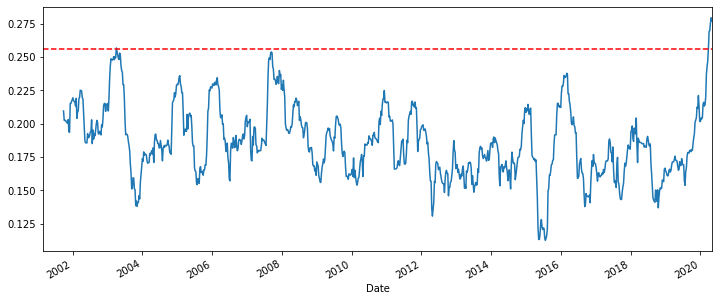

Source: www.sentix.de, own calculations, volatility of private investor sentiment, 30 week rolling (blue), pre Corona maximum (red)

The survey results exhibit exceptionally high levels of volatility, thus confirming the hypothesis that the current situation is in fact a period of extreme uncertainty. As the paper puts it:

Investment managers must exercise extreme care when assessing whether models that use such data remain valid.

Hence, the volatility of external data sources itself can shape our understanding of when it is actually wise not to use anything besides reliable metrics such as prices.

Last but not least, if you are a true Trend Follower and constantly on the lookout for new asset classes, there is one arcane area I’m sure you have not considered so far (maybe because there is no liquid market for it): Rare books. “Jane Beats Them All: “Price Formation and Financial Returns to Investing in Rare Books“ by Heinrich W. Ursprung, one of my former economist professors looks at rare books as an asset class. Who would have guessed that someone from the field of political economy would some day write something like this.

Estimating the financial return to investing in rare books in general, I arrive for the boom period 1975-2007 at a real rate of return of about 4.6%, which exceeds similar estimates for investing in fine art. In a comparison with the returns in 1975-2007 of almost 9% from the US stock market, investing in rare books is justified only by substantial nonpecuniary returns.

On the other hand, I might need to tell him that it’s not all about returns but correlations matter, too.

So long and #happytrading!