As outlined in part 1 of this article, Bitcoin mining uses a lot of power, and because this power isn’t 100% renewable, Bitcoin has a carbon footprint. That’s a fact.

A lot of the criticism that’s directed at Bitcoin is based on the assumption that it’s useless. A digital mirage which neither has substance nor intrinsic value. A scam of sorts that requires a power socket to run.

On the other side of that argument sits a market with more than a trillion in capitalization. It seems the market disagrees with the “it’s useless” argument.

If Bitcoin is useless because it uses power, what about Christmas lights? What about your microwave and all the air-conditioning systems that are installed but which aren’t really needed. Is your PlayStation life-essential?

The situation is similar — and even worse—for gold. One could argue that gold is useless because gold mining

- consumes a lot of fuel

- harms the environment, e.g., deforestation and erosion

- impacts animal and human life

- requires and pollutes water

- has a history of exploiting workers in underdeveloped countries

Additionally, once the gold has left the Earth’s crust, it costs a lot of money to store, secure, and transport from point A to point B. It develops a secondary carbon footprint each time it travels around the globe on ships and aircraft, which can happen when it changes ownership or when traders arbitrage spot and futures prices.

The smelting of gold and the production jewelry (also not a life necessity), require energy, too.

Disregarding the de minimis industrial use of gold, it’s easy to jump to the conclusion that gold mining is a waste. However, that waste seems to outweigh the utility of having gold available as an independent monetary medium, a storehold of wealth, and a desirable counterweight against currencies which are backed by nothing. The market seems to think that way, since otherwise the price of gold would drop, possibly toward zero, and mining would stop.

One should also recognize that our day-to-day currencies require a lot of power, too. While the fuel that’s required to print bills and mint coins is inconsequential, the cost of protecting the system through legal as well as national and international defense systems is not. The U.S. dollar requires several secondary payment and settlement systems, an international correspondence banking system, the Federal Reserve, and — of course — the diplomatic and military strength of the U.S. government to support and protect it all. It’s the same for other currencies. None of them are costless.

Bitcoin transactions, in contrast, do not rely on the support of any government. The Bitcoin network is all that’s needed. That’s a great feature (decentralized and trustless), but it’s undeniable that Bitcoin has a carbon footprint, because running the network uses power, which brings up the question: Is it worth it?

Transactions

Bitcoin transactions themselves don’t cause a lot of power usage. Getting the network to accept a transaction consumes almost no power, but having ASIC miners grind through the mathematical ether to solve valid blocks does. Miners are incentivized to do this because they are compensated for it. Presently, that compensation includes a block reward which is paid in bitcoin (6.25 BTC per block) as well as a miner fee (transaction fee). Transaction fees are denominated in fractional bitcoins and paid by the initiator of the transaction. Today, about 15% of total miners’ rewards are transactions fees, and about 85% are block rewards.

How much is a miner willing to spend on running a mining business? In the case of Bitcoin the miner’s primary business cost is power, and the incentive to spend can, in simple terms, be viewed as a function of the following variables:

- the current BTC price

- the BTC issuance rate as per the protocol

- difficulty

- the transaction fees which participants must pay to use the Bitcoin blockchain

Of those four, the first two have the greatest economic impact. The market capitalization of BTC, which continues to grow, is why miners are willing to incur a lot of power-related costs today. It’s very lucrative to get paid in BTC. And the lower a mining operation’s power costs, the greater its advantage over competitors, all else being equal.

Although miners are willing to spend a lot on power today to earn BTC, this does not mean that they will be inclined to use and pay for a lot of power in the future. Block rewards are a magnet for miners today, but Bitcoin’s issuance rate is halved every four years which means that, in the long run, miners’ revenues from block rewards will shrink. Note that close to 90% of all BTC have been mined already and, as mentioned above, fees are not a major source of revenue today. Most of the power-intensive block reward action has already happened.

Going forward however, miners’ primary revenue source will change from block rewards to the fees paid for the processing of transactions, which don’t per se cause high carbon emissions. Bitcoin is set to become be a purely fee-based system (which may pose a risk to the security of the system itself if the overall hash rate declines, but that’s a topic for another article because a blockchain that is fully reliant on fees requires that BTCs are transacted with rather than held in Michael Saylor-style as HODLing leads to low BTC velocity, which does not contribute to security in a setup where fees are the only rewards for miners.)

It costs a lot to build and operate a chocolate bar factory, but once the factory is up and running the marginal cost of a chocolate bar is tiny. Likewise, it costs a lot to create the “Bitcoin factory,” but the marginal transaction costs inside that factory are small.

To understand this better one needs to recognize that Bitcoin is not meant to do what Visa or Mastercard do today. Our current current monetary system consists of several layers: Slow but final settlement layers which process a relatively small number of irreversible transactions between banks. Those transactions tend to be large in size. On top of those final settlement layers are layers that optimize for more frequent and smaller consumer transactions, e.g., your credit card. Those transactions are reversible and thus not final. When you pay with your credit card at a store, that’s actually a transaction that your card-issuing bank will debit from your account and later batch into a netted omnibus payment with the store’s merchant bank.

Bitcoin is akin to the slow, but ultimate settlement layer, which is why a comparison to Visa or any other higher-frequency transactional layer is misguided. It compares apples to oranges.

But there can be several layers that work on top of Bitcoin and which allow for a greater frequency of off-chain transactions. These secondary layers can be either trusted or trustless. The Lightning network is one example of a trustless secondary layer which already exists today. It does not settle on-chain each time a transaction occurs and is thus far more cost-efficient than the Bitcoin base layer. With Lightning, many transactions can be aggregated and send to the Bitcoin blockchain for an on-chain final settlement. Now we’re getting closer to the neighborhood of Visa and other credit cards; but since the Lightning network requires much less power to operate and keep running (no mining), the comparison of power usage becomes more apple to apple. Using the Lightning network incurs a cost that’s akin to the cost of sending an email.

This also means that the power usage of the Bitcoin network won’t scale linearly with the number of transactions as the network becomes predominantly fee-based and less rewards-based (which causes a lot of power to the thrown at it in light of increasing BTC prices), and especially if those transactions take place on secondary layers. In other words, taking the ratio of “Bitcoin’s total power usage” to “Number of transactions” to calculate the “Power cost per transaction” falsely implies that all transactions hit the final settlement layer (they don’t) and disregards the fact that the final state of the Bitcoin base layer is a fee-based state which requires a very small fraction of Bitcoin’s overall power usage today (no more block rewards).

Power usage

Miners are economically incentivized to source cheap power as the marginal cost per unit of power that’s input into the mining process determines their competitiveness versus other miners. Renewable power is cheap (which is why miners use it), but the cheapest power of all is stranded (wasted) power.

Power is local and not fungible. It is difficult and costly to store and there’s no battery which is 100% effective.

Many Bitcoin critics complain that the power that’s used by miners could be used for other purposes — purposes which are more productive or socially beneficial. A good argument, but one that disregards the fact that the power used by miners could never actually become available for any other purposes.

Power decays as it leaves its point of generation and is expensive to transport across space. A lot of power is lost in transit, which makes it impractical to transport electrons over very long distances. This is why call our power system a grid — we require a grid because we need to produce power virtually everywhere to make it available locally.

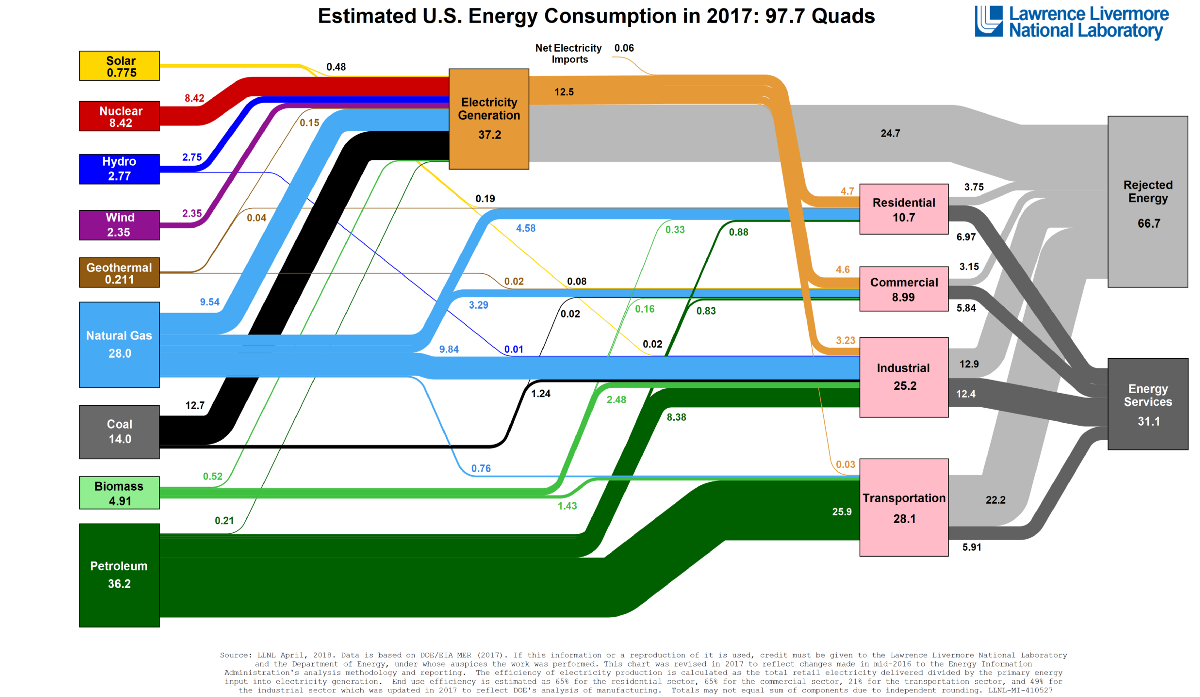

Below is a chart from the Lawrence Livermore National Laboratory. It shows that about two thirds of all generated power in the U.S. ends up unused (rejected).

Interestingly, the largest share of rejected power results from power generation itself — excess capacity that’s generated in case it’s needed on short demand. And that’s where Bitcoin makes a difference. Bitcoin does not waste power; it consumes power waste.

Bitcoin miners offer demand-side flexibility to a power generator, which is an essential aspect of our ongoing transition toward renewables. Since the wind does not blow all the time and the sun doesn’t shine at night, our future power grids require demand-side flexibility. Something that can be shut off and turned back on. Better to do that with an ASIC than with your freezer.

This will help balance the grid, make it more efficient, and it should ultimately reduce the retail power price a household pays. It will also reduce carbon emissions as the share of renewable sources can increase without overwhelming the grid or making its balancing too costly. And, as mentioned in part 1 to this article, miners already use a lot of renewables (zero carbon emissions).

Ultimately……

… it’s all a matter of opinion. Some people hate Bitcoin, some people love Bitcoin. I’m somewhat in the middle. I think Bitcoin is a great invention. I understand that the dollar, the euro and all the other currencies will debase over time. But maybe that’s a tax worth paying and it’s better to live in that world than in a world that’s based on the existence of a non-state, synthetic monetary medium over which governments have no control. I’m not sure and want to think about it more. However, I do have an issue with the “Bitcoin wastes power” argument and I think it’s wrong. People are willing to pay for transactions on the blockchain. That’s a fact, and the cost of that service is essentially derived from the resources which are required to offer it. How can it be a waste if people want it and pay money for it? In a market that’s worth more than one trillion? Same thing for gold. Millions of people are willing to pay for physical, state-independent gold, which is why it continues to get extracted from the ground at huge costs.