Those of you who are long time subscribers already know. We like to talk about pieces of algorithmic art, such as the graphics on our website or our all-time favorite by Manolo Gamboa.

And we like alternative asset classes. Not just since Janet Yellen promised to “act big” on financial easing at her nomination hearing to be US Treasury Secretary in January. This “spend now – pay later” attitude is well known from the 1950s. It’s called financial repression, keeping rates low to help fund national debt, while the Treasury engages in greater fiscal activism. A world of loose monetary and fiscal policies.

In fact, throughout history, governments have used this technique to transfer wealth from the prudent saver to the balance-sheet constrained and reckless borrower. The biggest culprit in this latter category is usually government itself.

We are no macroeconomic experts, but usually one should assume some linkage between money supply, inflation and GDP growth. So, wouldn’t it be nice to have something that grows in value alongside money supply?

Over time there are certain types of assets that can mimic money printing that do not carry the same risks as fiat money. Among other things, these are physical assets with longevity, multinational demand, scarcity and no correlation to equities.

You got it. We are talking about SWAG. SWAG is a terrible acronym that stands for Silver, Wine, Art and Gold. As urban dictionary points out: “SWAG is a word that was extremely overused from late 2010 to early 2012 and is now nothing more than a joke.”

Bitcoin agrees

While Bitcoin is not physical in the sense that Peter Schiff likes his physical assets – sorry Peter, no touching – it ticks most of the boxes of the SWAG assets without the need to create a new acronym.

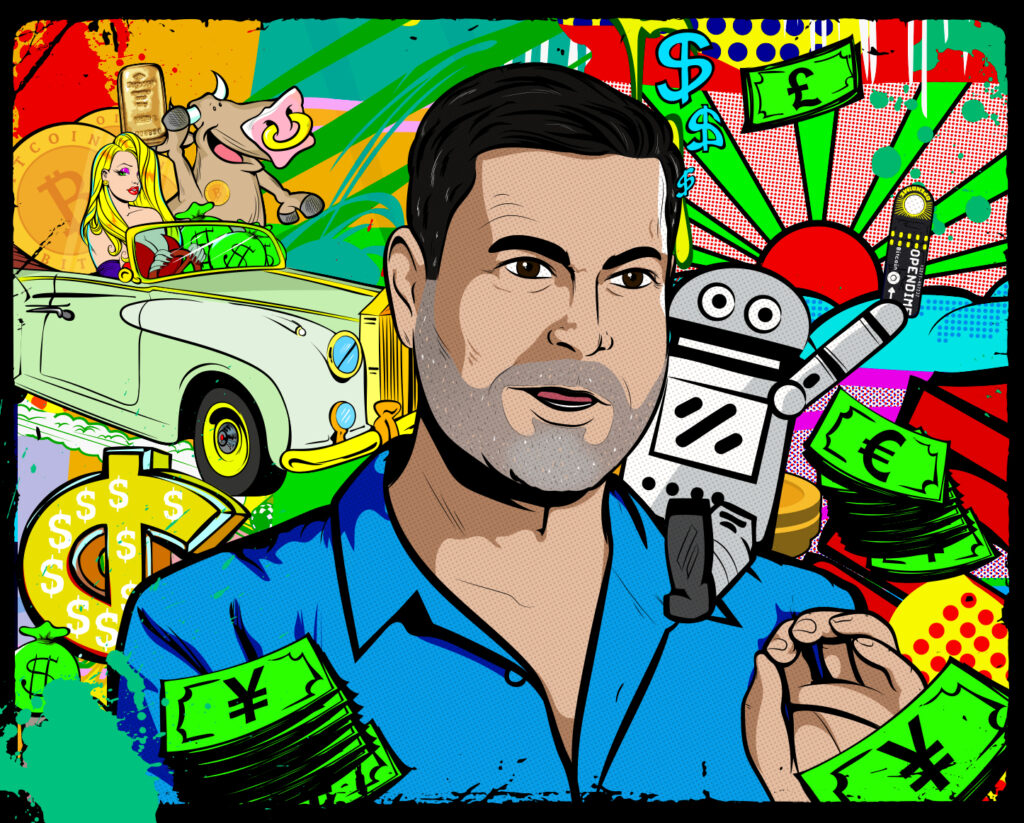

To commemorate the rise of Bitcoin and to make the race between the new digital gold and the old physical gold a bit more interesting, we commissioned an extraordinary piece of pop art.

In addition, we wanted it to remind us of our more moderate ascension to the blogosphere, which coincidentally started in 2020.

After our first steps as bloggers (Bitcoin cash & carry trades!) and the birth of the Real Vision Bot, a research project on artificial intelligence, we became acquainted with Raoul Pal, co-founder of Real Vision. Raoul did not only coin the term “irresponsibly long”, but also warmed up to our little Bot and gave Moritz S. the opportunity to act as guest interviewer on the platform.

Interpretation or #irresponsiblylong

What would be more fitting than to put Raoul & Bot into the spotlight. Rising behind them is the sun, to mark the start of a new era of either monetary policy or Bitcoin adoption? The Bot triumphantly holds an Opendime hardware wallet, which is actually included with the picture and comes with 0.005 BTC. In the background, our gold bull rides in style (old school), with a beautiful woman (memento mori) at his side and a bar of gold in his hand. A physical 0.08 oz. bar of gold is included with the art. Fiat money floats around (and away), Bitcoin hunts the bull and if you look really closely you can even discover Michael Saylor’s face hidden right next to … no, we won’t tell you, you have to find the Waldo of the Crypto world by yourself.

Give your BTC and gold the place they deserve in this strictly limited-edition picture and invest in the holy trinity of alternative assets (and take a sip of wine while you admire the view). It costs €1,000 and you can pay for it with your dirty fiat money.

Yes, Raoul already has one. After all, he truly is #irresponsiblylong.

And please, let’s all forget the SWAG thing ever existed. For the sake of fine wine, great art and shiny metals.