The digital gold narrative is compelling, but it doesn’t show up in correlation numbers

This post is a quick follow up to our recent “Post-election melt up” article which you can read here and where we had a look at how some of the most relevant financial markets performed in the two weeks before and after the US elections. To recap, risk-on assets such as stocks and credit rallied after the Election Day on November 3, but fared poorly going into the election. Risk-off assets such as bonds showed the opposite behavior. The notable exception was bitcoin (BTC), which apparently didn’t care much about the elections and just moved higher.

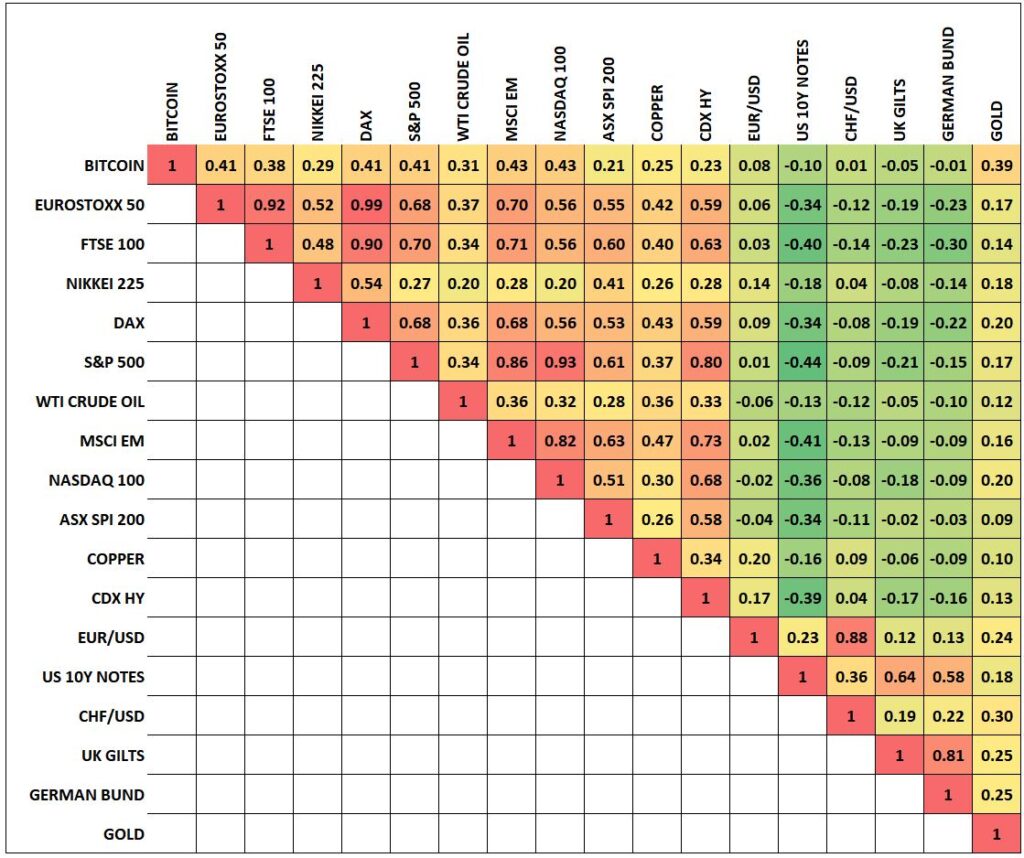

Historically, BTC has shown no meaningful correlation to the returns of other assets, and hence adding BTC to a portfolio has been highly attractive from a risk-return perspective. The matrix below shows the correlation characteristics of several important markets since the end of last year. The time period is 30 Dec 2019 to 20 Nov 2020 and the calculations are derived from daily data of generic front-month futures time series.

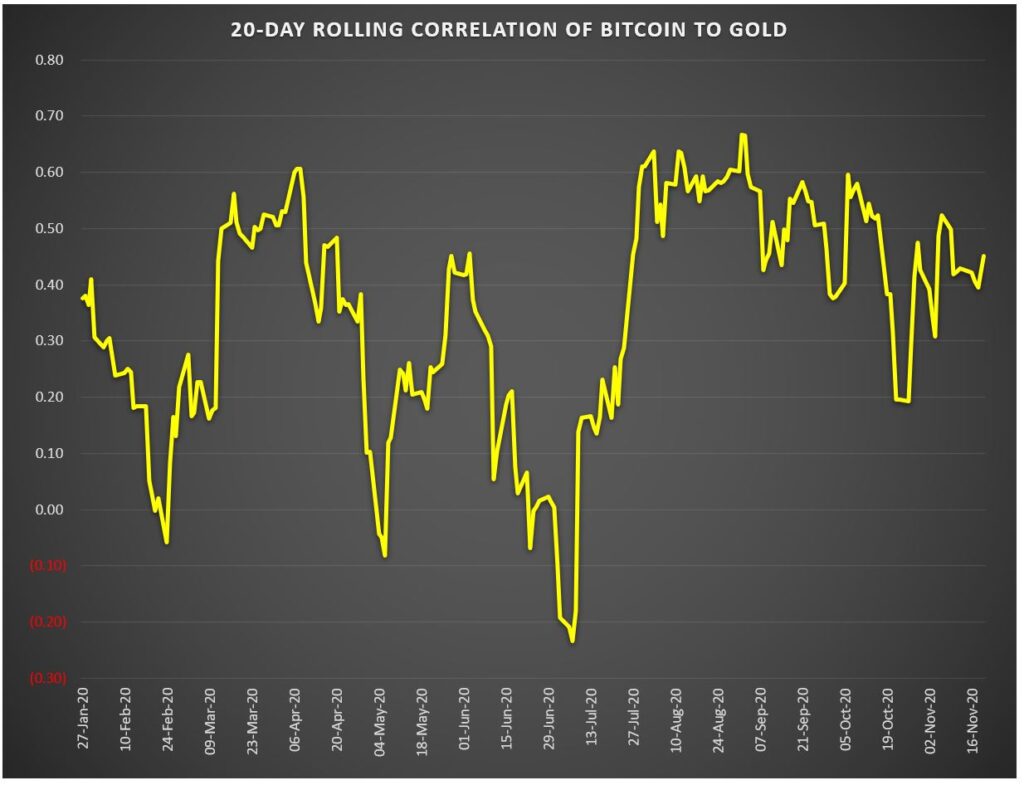

BTC has shown a mildly positive correlation to equities thus far in 2020 – higher than in prior years – but also a somewhat positive correlation to gold. While we can see the usual correlation clusters in bonds and equities, I was surprised to see the S&P 500 vs. US 10Y Notes correlation at -0.44 given all the news about a breakdown in equity-rates correlation and the damage that this shift has supposedly done to risk-parity portfolios. That aside, I wanted to have a look at the BTC vs. gold correlation since the “digital gold” or “gold 2.0” narrative has become increasingly popular and talked about in recent months. The below chart depicts the rolling 20-day correlation (again using daily data of generic front-month futures time series).

To a quant this is just noise. We certainly cannot jump to the conclusion that BTC behaves similar to gold, or the other way around, regardless of how much people use the digital gold narrative. There’s a chance that this correlation will increase going forward if investors start considering gold and bitcoin as similar storeholds of wealth, one digital the other physical, with different properties and attributes, but also many similarities. On the other hand, if investors look at BTC as a form of gold 2.0 – a better form of gold – then the price of gold may drop while the price of BTC goes up, up, up. In that scenario the correlation between the two may even become negative.

Source for market data: Bloomberg L.P.

Stay safe and #happytrading.