“Gold is money. Everything else is credit.”

J.P. Morgan, 1912

I think that’s a great quote. Old but gold, so to say.

Now, more than 100 years later there’s Bitcoin.

If gold = money, does that mean digital gold = Bitcoin, and does that therefore mean Bitcoin = digital money?

I don’t know whether these simple equations are correct, but I guess they’re not totally wrong either.

Before diving into Part II, I’d like to restate what I believe is a key take-away from our Part I, which you can read here.

What’s the downside? Bitcoin goes to zero, or close to zero, or you lose your keys, etc. That’s all possible, but you must frame these risks relative to the upside potential of the bet. The upside? Nobody knows how high the price can go, but I think it’s fair to say that it could be multiples of where it is today. That’s the asymmetry – it’s like a call option. Back to my earlier statement of “the risk of not being long is greater than the risk of being long.”

I really believe this is true. Can you afford to stay on the sidelines if Bitcoin goes 10x, 20x or whatever-x, knowing that your downside is $11K per coin? Think about that.

One important aspect I forgot to mention in the above “call option” comparison is that this a very special call option – one without an expiration date, and thus no theta.

But let’s now have a closer look at some of the reasons for our bullishness. In summary, the main drivers are:

- The macroeconomic environment

- Scarcity of Bitcoin

- Increased use of Bitcoin and wallet growth

- Possible adoption by institutional investors

- Launch of additional Bitcoin-tracking ETPs (e.g., an ETF in the USA)

- IPOs of digital asset exchanges and service companies

- Bitcoin becoming seen as digital gold

It’s best to tackle them one by one.

1. The macroeconomic environment

Interest rates are near zero or below and monies and debts are being created at an unprecedented scale. Under these circumstances I cannot imagine a scenario in which bonds will not lose value in real terms (my view is on the next 5-10 years). There may be deflation in the short-term, but my bet is on inflation in the long-term.

You see, all major central banks follow a path of quantitative easing while Bitcoin follows a process of quantitative tightening. The question is: How does this end? Inflation is a possible outcome, leading investors to increase allocations to precious metals such as gold and silver, real estate as well as infrastructure assets, and commodities. So, why not also a little bit of Bitcoin?

2. Scarcity of Bitcoin

21 million Bitcoins. No mas. This number is set in stone (well, code) and the last coin is expected to be mined in more than 100 years from now. Today there are about 18.4 million Bitcoins in existence (close to 88% of the total amount) and about 900 new ones are mined each day. The inflation rate which is programmed into the Bitcoin protocol is declining; in other words, the speed at which new Bitcoins come into existence slows down over time and, in fact, the inflation rate is cut in half with every halving cycle. Hence, Bitcoin is becoming increasingly scarce over time – a unique feature compare to other assets, especially currencies such as USD, JPY, or EUR where “the sky is the limit.” To me, a Bitcoin halving is akin to a Bitcoin “hardening” because it results in an increase in the stock-to-flow ratio. I recommend you have a look at PlanB@100trillionUSD’s website to learn more about Bitcoin’s stock-to-flow and how this metric may be relevant for the price of Bitcoin going forward.

Bitcoin is scarce, durable, divisible, portable, storable, fungible, and verifiable with global acceptance. Thus, it shares the characteristics of money, with the important exception that it is not controlled by any central authority. The mining hash rate and the number of independent devices operating on the Bitcoin network create a collective and adaptive framework of stability. This stability comes at a cost though, and this cost is electricity. Running the Bitcoin network consumes more power per year than countries such as Ireland, Belgium, or Switzerland. Sounds crazy, but the widespread and expensive participation in this network makes an outside attack very difficult – and that’s a good thing. In fact, the Bitcoin network has never been hacked. When you read about hacks it’s mostly a break into the systems of an exchange and the theft of private keys stored online.

3. Increased use of Bitcoin and wallet growth

The more people use Bitcoin, i.e., the greater its adoption, the more attractive it becomes as a means of payment and a storehold of wealth. Increased use attracts other (new) users and drives positive sentiment.

According to data from Glassnode, more than 1 million unique Bitcoin wallets are active each day either as sender or receiver. This number is growing. Glassnode also mentions that, over time, Bitcoins have moved from the whales to smaller holders, indicative of Bitcoin being increasingly used for a broader range of day-to-day transactions, e.g., in emerging markets and countries suffering from ongoing currency devaluation.

Finally, I hear more and more people talking about digital assets, and Bitcoin in particular. It seems Bitcoin is now an essential part of every conversation about markets or investing – like a VIP guest at a cocktail party. “OK, you have holdings in equities, bonds and, yes, gold.” But toward the end of the conversation, like clockwork, there’s the kicker-question: “And what do you think about Bitcoin?” You see, it’s on peoples’ minds now and I don’t think it will go away anytime soon. Paul Jones and Mike Novogratz are on it, others will follow. Bitcoin has become sticky.

4. Possible adoption by institutional investors

Institutional investors are still largely on the sidelines. First and foremost, allocating to Bitcoin comes with a lot of career risk (as does allocating to other alternative investments, including precious metals). There’s a great chance of looking stupid if something goes wrong (a hack, a loss of private keys, a large drop in price, and so on). Secondly, most CIOs have grown up in a delivery-versus-payment world where security transactions settle T+2. But Bitcoin doesn’t work that way.

I understand that the barriers to entry are high, but they are not insurmountable if CIOs are open-minded and willing to embrace new technologies. There’s a good chance this will happen (with the tailwinds mentioned in point 6 below), and some have already made the move. MicroStrategy, a Nasdaq-listed intelligence company recently announced that they have purchased 21,454 Bitcoins as part of their capital allocation approach and that Bitcoin is now their primary treasury reserve asset.

Once institutional investors start allocating (only a tiny bit) to Bitcoin, we’ll likely see much higher prices. It will be akin to Bitcoin becoming “knighted.” It will be rock’n roll for its price.

One aspect we all need to accept though is Bitcoin’s volatility. Since the supply of Bitcoin is inelastic to changes in demand, its price is very volatile. This is quite different in other markets, for instance in the oil markets (remember May 2020) where the supply side can be very elastic to demand. Increased adoption of Bitcoin should result in lower price volatility though (a guess on my part).

5. Launch of additional Bitcoin-tracking ETPs (e.g., an ETF in the USA)

Many investors, both retail and institutional, have issues with spot Bitcoin. There seem to be too many risks: The private key, hot wallets, unregulated exchanges, and so on. All fair points. But what are the alternatives to spot Bitcoin?

Futures, for example. Nowadays there’s an ICE-traded futures contract, physically settled using the BAKKT warehouse, and there’s a CME-traded contract which is cash settled. The CBOE-traded contract, which was the first one to come into existence, no longer exists as the market’s liquidity started to concentrate in the CME contract which was launched a few days later.

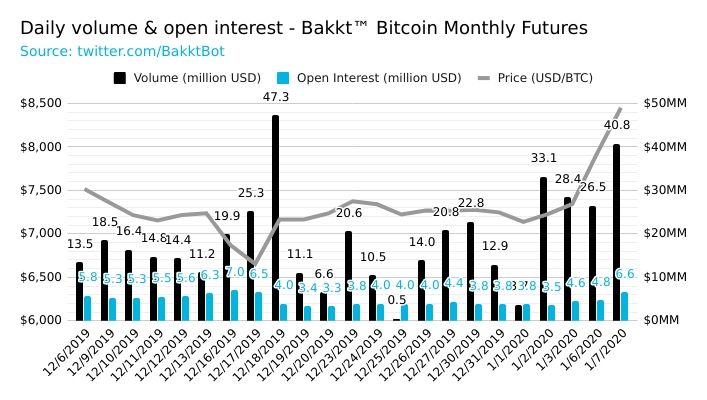

These futures contracts have several benefits for institutional investors: they work like any other futures contract (initial margin, variation margin) and the risk is against the clearing house of the exchange. It’s really no different than trading S&P 500 e-minis, except the margin requirements tend to be higher, especially for short positions, something we have written about before. The demand from – presumably, institutional investors – causes the basis (implied funding rate) of these contracts to the relatively high. Natural demand is greater than natural supply, and the balance sheet costs of brokers which make markets and need to hedge are high. While volumes are still moderate, there has been increasing trading activity in these contracts, see for example the illustration for the BAKKT contract below. Noteworthy is the increasing average daily volume since the start of the Corona crisis in 2020.

There are also “futures” contracts listed on digital asset exchanges, but it seems most institutional investors tend to stay away from them. One exception to this may be LedgerX.

Finally, there’s ETPs. I think this is where the greatest growth potential lies. Grayscale has several digital asset trusts, with the Grayscale Bitcoin Trust being the most popular and largest one. That said, it tends to trade at a significant premium to NAV for the convenience of not having to worry about custody and private keys (+19% premium as of 25 August 2020) – similar to the futures contracts.

Europe has a couple of tracking products in note-format, Canada has a fund, other countries have other things. What’s really missing though is an ETF – a large, liquid ETF with a low tracking error to spot Bitcoin and reasonable fees. When, not if, such an ETF is launched I can only imagine the price reaction of Bitcoin to be very bullish as such vehicle will allow an “easier way in” for institutional and retail investors alike.

(Oh, and then there’s companies that change their names from Long Island Ice Tea to Long Blockchain, etc.)

6. IPOs of digital asset exchanges and service companies

Digital asset exchanges and blockchain service companies (e.g., digital asset custody firms) are becoming increasingly institutionalized and regulated. Some of them are about to IPO, e.g., Diginex. This is a good development – both for investors and the recognition of digital assets generally. It makes the trading and holding of digital assets safer and easier and counters the “it’s only drug and black-market money” argument. The more this happens and the easier it becomes to get exposure to Bitcoin, the higher – most likely – its price.

Moreover, blockchain technologies are at the forefront of innovation in many industries, one of which is finance. The transfer of funds, for example, is still stuck in the dark ages as SWIFT transfers may well take more than 24 hours to complete. Blockchain technologies would allow funds to be send with the speed of an email or WhatsApp message. The same goes for the settlement of securities transactions (T+2, T+3). This will go away, and securities will likely become digitalized – all developments that should be positive for the price of Bitcoin.

7. Bitcoin becoming seen as digital gold

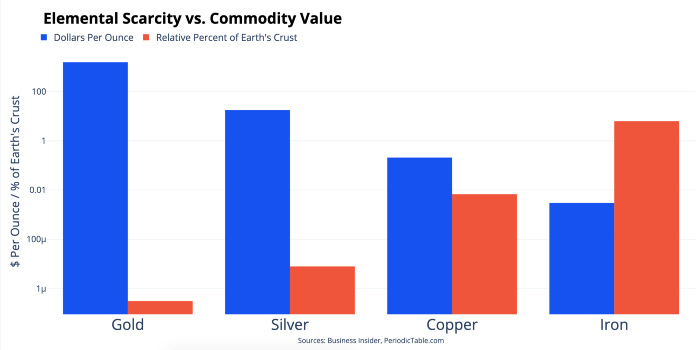

Bitcoin is scarcer than gold because more gold is found every day, albeit at a declining rate, whereas the total number of Bitcoins has a hard limit. Like gold, Bitcoin qualifies as a storehold of wealth – a digital rather than physical storehold of wealth.

Some people argue that Bitcoin has no real (industrial) use whereas gold does. I think that’s vastly exaggerated since, with the exception of jewelry and dental gold, there’s no real use for gold either – other than it being placed into a vault.

Although gold has a several thousand-year head start on Bitcoin, there’s a good chance that Bitcoin will become seen as digital gold – not necessarily replacing gold but having a co-existence alongside it.

#happyhodling