Yesterday, we decided to get back into the bitcoin cash & carry trade as the CME futures basis traded at greater than 35% annualized in the early afternoon European time. We bought 5 bitcoin on Bitstamp at $19,515 including the 0.25% transaction charge and simultaneously sold 1 Dec 20 CME bitcoin futures contract at $19,875.

At the time of writing this blog (2 Dec, 1pm CET), the CME futures basis trades at ~22.5%. Because of this narrowing from 35% down to 22.5% within one day, our position now shows a PL of $623. There’s another $1,160 to go if we hold the position until the expiration of the futures contract on 24 Dec.

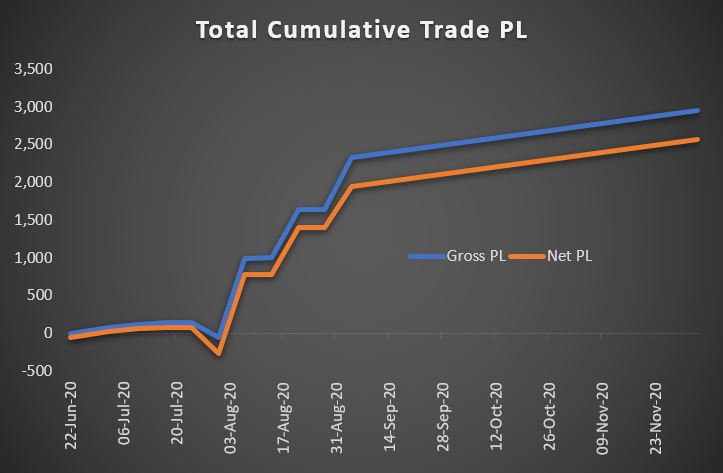

The combined PL of our ICE and CME trades for the year 2020 now amounts to $2,947 gross ($2,563 net).

Trade history

- 22 Jun: Sell 2 July 2020 ICE Bitcoin futures contracts at $9,482.5

- 22 Jun: Buy 2 spot BTC on Bitstamp at $9,415.35

- 14 Jul: Rollover Jul-Aug ICE Bitcoin futures at $85 (+2 July at $9,210, -2 August at $9,295)

- 30 Jul: Sell 1 Aug 2020 CME Bitcoin futures contract at $11,255

- 30 Jul: Buy 5 spot BTC on Bitstamp at $11,021

- 17 Aug: Rollover Aug-Sep ICE Bitcoin futures at $215 (+2 Aug at $12,185, -2 Sep at $12,400)

- 19 Aug: Rollover Aug-Sep CME Bitcoin futures at $160 (+2 Aug at $12,035, -2 Sep at $12,195)

- 2 Sep: Closing positions. Buy 1 CME Bitcoin futures at $11,460, buy 2 ICE Bitcoin futures at $11,445, sell 7 spot Bitcoin on Bitstamp at $11,395

- 1 Dec: Buy 5 spot BTC on Bitstamp at $19,515.

- 1 Dec: Sell 1 Dec 2020 CME Bitcoin futures contract at $19,875.

The net PL includes the following:

- 0.25% one-off charge at Bitstamp when buying spot BTC

- Futures commission: $4 per lot per side (rollover trades will be included)

- Funding charge (spread) on futures margin: We assume a margin funding charge (spread) of 0.25% per year (the actual number depends on your broker). The initial margin requirements also depend on your broker. We assume 200% initial margin for a short position on ICE, and 70% initial margin for a short position on CME.

You can find the trade details of the earlier BTC cash & carry transactions on our blog page and a more detailed explanation of the trade here.

Note that this is only an idea. It is not advice of any kind as pointed out in our Terms and Conditions.